Well, America, here we are again.

The average U.S. citizen’s discretionary spending capacity is down about 33% thanks to inflation, the struggling value of the dollar on the world market, high loan interest rates, and the re-dispensation of rent bills and student loan debt.

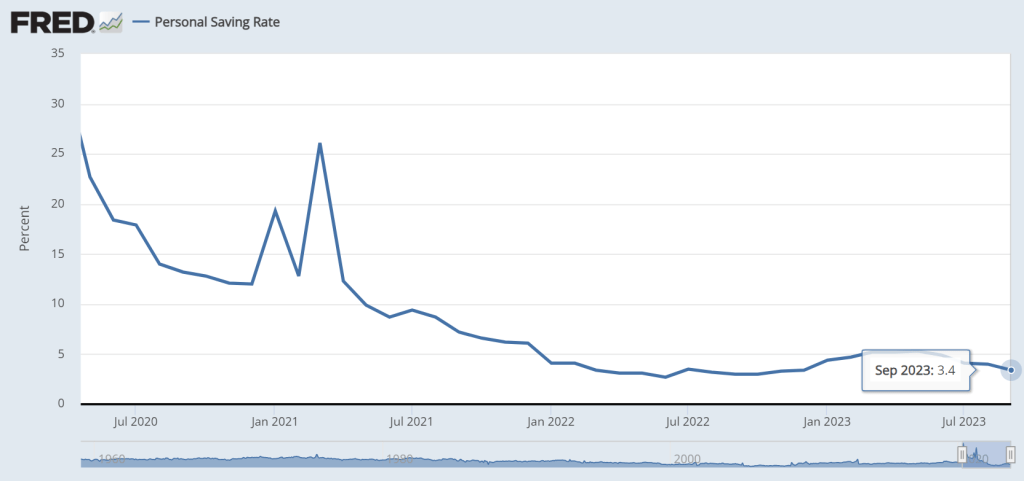

So understandably, personal savings are down. People are having to drain their coffers to keep their houses, keep food on the table, and keep that sweet, sweet Disney+ subscription.

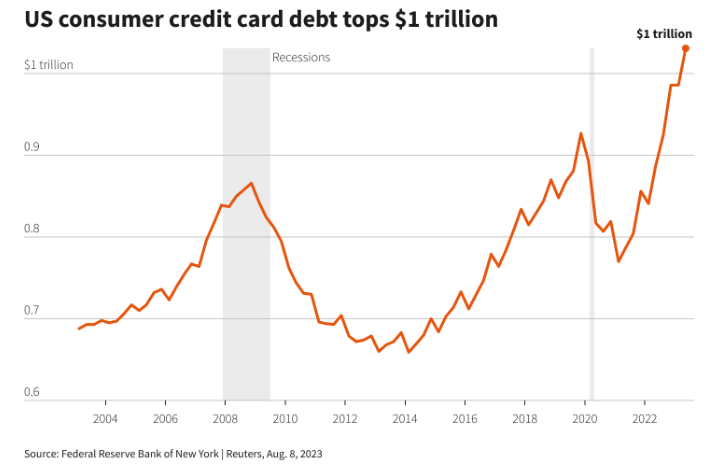

Also, American debt is at a record high. Our credit card debt alone crossed the fabled one trillion dollar “milestone” in August … and has been skyrocketing ever since.

But something like that could never pin down the American consoomerism spirit. We’re too obsessed with stuff. Too consumed by greed. Too programmed to Buy Next Product to stop now.

In fact, let’s travel by plane. Cruises, vacations, timeshares, new cars, cheap smert TVs, you name it.

In fact, a few days ago was the busiest day ever at U.S. airports. The TSA reported that 2,884,783 rubes got screened through the draconian airport system that day.

Folks, flying is a luxury. You can rent a car and get an entire family where you need to go for a fraction of the cost of a single airline ticket.

And then came Black Friday. And its evil twin, Cyber Monday.

Surely we were able to control our discretionary spending impulses this year, right?

I mean, sales couldn’t have been all that strong considering that so many U.S. citizens are struggling to make ends meet, can’t seem to save money, and keep sinking deeper in debt, right? Rent, home, car, grocery, and gas prices are up, after all, so we have less money to be throwing around at Shiny New Thing. Right?

No. As they say, “A fool and his money are soon parted.”

Right on cue, the Black Friday zombies came out in droves, fighting each other like animals and pissing their money away in record numbers, spending a record $9.8 billion USD, up 7.5% from last year and quite a bit higher than even the experts had projected. (They tried their best to predict our level of stupidity, but we somehow proved ourselves even stupider.)

$79 million of the Black Friday money spent were by consumers who opted for a “Buy Now, Pay Later” option, finding ways to put themselves even deeper into debt. Zoomers–who have claimed to have trouble making ends meet and have the lowest rate of home ownership–were the lead spenders this time, and online retail surpassed store retail for the first time in history at more than 50% of the transactions.

$5.6 billion USD was spent on the day prior (Thanksgiving day), up 5.5% from last year.

And Cyber Monday? Another record-breaker at $12.4 billion spent, up 9.6% from last year. That’s $12.4 billion spent that we don’t have. Between 10 PM to 11 PM that day alone, customers were spending $15.7 million every minute.

When the dust cleared, in the span of Thursday through Monday, consoomers had somehow managed to spend a total of $40 billion USD.

Surely this is a good sign, you say. It means the consumer is strong!

Well, that’s certainly the way the media spins it. But if consumers are so strong, then why aren’t they paying off their debt instead of suffering 18.00% to 24.99% APR on their credit cards?

Oh, and delinquency rates are way up, too.

So what is it Americans couldn’t go without this time? What did we have to buy?

Well, among the top 17 items sold on Amazon were a “Snail Mucin” moisturizer, more Amazon Fire TV sticks (don’t people have enough of these already???), Ring video doorbells (Ring doorbells give you ZERO privacy and the employees will dox you to the lowest bidder), whitening strips, the “Taco Cat” card game, Woobles, and Smert phones.

Nothing in this list is worth buying, let alone going further into debt for. Are we really so pathetic?

Folks, we can’t afford to keep pissing away our money like this on crap, junk, and garbage. Putting yourself into crippling debt in exchange for stuff is a Faustian bargain. If you’re part of the problem, please show a little self-control. I’m begging you.

One thought on “Bleak Friday”